Over recent years we seen a raise in interest for vintage Cartier watches, obviously its very easy to understand primary because of the lack of minimalist watches with a sense of heritage and style, you might disagree with the statement I just said and argue the Patek Philippe Nautilus has heritage, style and also a very minimalist design and you might be right the only issue is that pretty much everyone in 2022 want this watch and in certain circles pretty much "everyone" has this watch, not to mention a Rolex Submariner or any other steel sports model from any mayor brand.

This is exactly where Cartier stands out, the appeal is pretty much imposible to copy I mean you could throw a roman numerals dial in a squared watch and say its the same, the problem is that it wont be because it will lack the most important out of this 3 things I mention, Heritage. There is no other watch that lasted 100 years being the ultimate expression of fashion and style like the Cartier watches did specially the Tank model, now people are starting to notice that with a sense of value which goes hand to hand with modern hype and collectability.

For sure the reason why someone paid $1,650,000.00 for a first edition cartier crash from 1967 is not near the same reason someone pays that kind of money for a Patek Philippe Nautilus with a green dial or any limited edition Richard Mille or is it? I believe the perception of value this days is more subjective than ever before, certainly "Hype" is a phenomenon we seen in all types of limited, restricted or supply regulated assets we seen lately, that shows that all of us want the same stuff and will fight for it with cash.

Thankfully the market makers are intelligent and limit supply to a resource maximization, thats why the maximum supply of Bitcoin is 19 million and why Rolex produce one million watches a year. Now think about this, there only exists a handful of nice vintage Cartier watches in the world and they are appealing to a much much wider audience than ever before, for me the braking point was when I saw a photograph of Kanye West wearing a Cartier Crash for the first time "Were done" I thought, the vintage watch market is about to explode and it did, or has it?

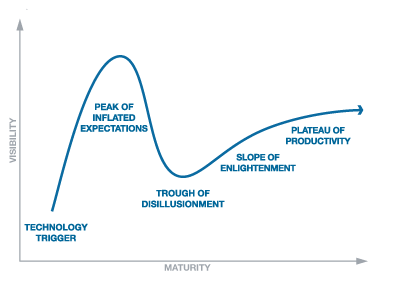

Lets dive in the Hype Cycle explanation

This is a Hype Cycle explained very simply, as you can see we have a trigger that rally the interest or "Visibility" of this new trend in this case Collectible Cartier, then we see mayor upside with no stops until the peak of inflated expectations is reached, something we can clearly see in modern Hi-End sports watches such as Rolex, Patek Philippe and Audemars Piguet, we all are unsure how pronounced the down trend will be until we reach the "bottom" or thought of disillusionment as economist call it for this market but its certainly the part of the slope were about to experience now, on the other hand the more we compare this market to Collectable Cartier the more I realice we still have plenty room to grow interest in this market, the fact that we still have to see public diffusion scale to higher levels gives me confidence and support to believe the Cartier Crash from 1967 will reach 5 million dollars in the next couple years, another model that I see doing extraordinary in the near future is the "Pebble" which already archived extraordinary results last year in May 2021 at Phillips Geneva Watch Auction Xlll with a hammer price of CHF 403,200.00 or $406,000.00 USD, this particular watch is one of only 6 examples produced by the London Cartier House in 1972 and has a very distinctive aesthetic thanks to its squared dial and rounded case. Will we ever see one of this pieces in a celebrity wrist? I highly believe so and only time will tell.

Photography Rights

https://swisswatches-magazine.com/